our services:

Whatever stage of life cycle your brand or product is in,

we can provide full range of solutions that suit your very needs and help you succeed.

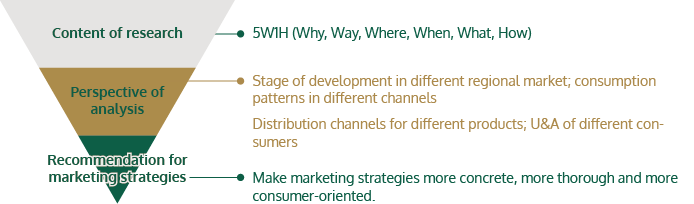

In-depth Industry Insight Research: solutions for market entry, market positioning and strategies for deep industry exploration...

In-depth Industry Insight Research helps you decide on the direction and strategies of companies based on evaluation of your own strengths/weaknesses, as well as opportunities and challenges in the industry.

- Solutions for market entry: We analyze the size, performance and potential of different industries.

- Solutions for market positioning: we analyze key driver of the industry, consumers' characteristics, major competitors and their strengths/weaknesses, and gaps in the market.

- Solutions for marketing strategies: we analyze trends of the industry and its key drivers.

What are the features and strengths of our in-depth industry insight research?

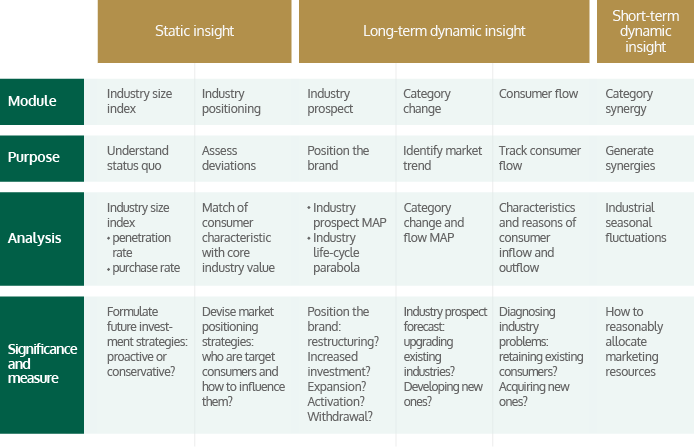

- We divide in-depth industry insight research into static insight (the current performance of the industry), short-term dynamic insight (industry development pattern), and long-term dynamic insight (industry prospect).

- We help you apply research findings to practice with the effective research tools, such as strategic tools for industry development and for industry life cycle assessment.

- We conduct consumer research from an industry perspective. We believe that research is not isolated work. To make research findings informative for clients' business growth, consumer information must be analyzed in terms of larger context of industry and market.

- We build independent research teams for different industry so that our research experts can offer more specialized industry research service to clients.

What services are provided in our in-depth industry insight research?

case study

Typical projects of our in-depth industry insight research - FMCG Industry:

What was the project background?

Yogurt brand A intended to enter the Chinese market in cooperation with a local manufacturer. But it knew little about the yogurt market in Mainland China and faced the following questions:

- What do Chinese customers know about the sub-categories of yogurt? What are their attitudes towards the sub-categories? What's the status quo of consumption?

- Who are the main competitors? How's their market performance? What are their market positioning and brand images?

- What are consumers' U&A in purchasing and drinking yogurt?

- What are consumers' life style and media usage?

What did we do?

To meet the needs of yogurt Brand A, we worked out a tailored research plan, which can be divided into three stages:

- Stage One (preliminary research). We randomly interviewed 3000 consumers by means of CATI to obtain data concerning penetration rate and market size of yogurts in mainland China. CATI was used for two reasons. Firstly, with 90% and 70% of Mainland citizens using telephones and mobile phones respectively, we had access to a large group of respondents. Secondly, the computer phone-number database provides us with random samples.

- Stage Two (in-depth research). We organized 21 focus groups to better understand the consumers' attitude, motivation and thoughts about different yogurt sub-categories. Focus groups were held for three reasons. Firstly, an in-depth research requires more open-ended discussions. Secondly, featuring constant interaction, focus groups allow researchers to collect more valuable information. Thirdly, the pattern of focus groups is flexible enough for researchers to identify new questions and facilitate further discussion.

- Stage Three (zoom-in research). Setting quota for different yogurt sub-categories, we interviewed 2,100 consumers by means of central location test (CLT) in order to make quantitative analysis on consumer behavior and brand performance. CLT was used for two reasons. Firstly, it enables us to approach large consumer groups. Secondly, it fulfills the sample quota more easily.

What was the outcome?

We have successfully helped Brand A to better understand the yogurt market in mainland China. The following research conclusions (partial) provide constructive reference for its successful market-entry.

- Probiotic yogurt and active Lactobacillus drink will become sub-categories with the biggest potential in yogurt industry.

- The fact that consumers do not have a clear idea of each yogurt sub-category helps a new brand to enter the market.

- Based on Boston Matrix, we help Brand A to formulate marketing strategies for different sub-categories by identifying their growth potential.

In-depth consumer insight research: solutions for locating your target audience and devising marketing strategies

- While you may have been very successful in a certain industry or a regional market, understanding the target audience is crucial for you to enter into a new industry or region.

- Our in-depth consumer insight research enables you to understand more about your consumers' U&A, lifestyle and values. In this way, we help you locate the right target audience and make corresponding marketing strategies.

What are the features and strengths of our in-depth consumer insight research?

- Rich experience: over the past five years, we have completed 40 in-depth consumer insight research projects with over 100,000 samples. Moreover, with our systematic research models, we guarantee in-depth analysis and practical research findings.

- Unique research tools: in order to gain a keen consumer insight, we employ practical research tools, such as Workshop in-depth insight tool and consumer demands exploration tool.

What services are provided in our in-depth consumer insight research?

Product/Brand Choice: Usage And Attitude (U&A) Research

- Designed to study consumers' habits and attitudes, the U&A Research is a comprehensive, flexible and practical rese arch tool.

- The U&A Research provides information on consumer usage and purchasing habits, attitudes toward products/brands as well as brand competitiveness in the market.

- This information offers suitable solutions to marketing management in the following areas.

Values And Life Styles Research

In addition to their usage of and attitudes towards a specific brand/product, our consumer insight research also explores their values and life styles in order to understand the fundamental reasons for their choices.

- Life style: life style is the way a person spends time and money, namely life behavior (how one spends time on work/study, family, being alone and media) and consumer behavior (how one spends money on food, clothing, shelter, transportation and entertainment).

- Values: a person's value orientation, as represented in the Powerful Model

- Person: a person's demographic and natural characteristics

- Occupation: a person's aptitude, interest and preference for an occupation

- Want: commodities, service or reputation a person needs and desires

- Ego: one's personal values

- Respect: figures a person respects and why

- Follow: things or figures a person tries to follow

- Uniqueness: aspects a person tends to show his/her uniqueness in

- Let go: things a person is most likely to abandon and despise

case study

Typical projects of our in-depth consumer insight research - Cosmetic Industry:

What was the project background?

Cosmetic Brand A intends to launch new products in tier 2-3 cities of China. With current concentration on tier 1 cities, however, Brand A knows little about consumers in tier 2-3 cities. Can its past success in tier 1 be reproduced in tier 2-3 cities? What are the characteristics of the consumers there? What are vital to the brand's R&D and marketing planning?

What did we do?

Our cosmetic research team is commissioned to undertake online surveys covering over 4000 women from 7 administrative districts of China and most of the tier 1-3 cities. Online survey is carried out for the following reasons. 1) Random: random sampling reflects the market specifics. 2) Comprehensive: online surveys overcome geological limitations and ensure high response rate in representative areas. 3) Cost saving: large expenses for business trips are saved. 4) Feasible: our professional database of cosmetics consumers gives access to larger population and makes the sample more representative.

What was the outcome?

The project focuses on the following questions: 1) What are the characteristics of cosmetic consumption by women in tier 2-3 cities? 2) What are the implications for the marketing campaign of Brand A? 3) How should the Brand market its products according to a market segmentation of the female consumers in tier 2-3 cities?

Our research findings have helped Brand A to better understand the characteristics of cosmetic consumption by women in tier 2-3 cities.

- Compared with consumers from tier 1 cities, those from tier 2 values more the flaw-hiding effect of cosmetics while their skin-care awareness is weaker.

- Women from tier 2-3 cities tend to spend less in single consumption but with slightly higher frequency. Their total consumption is only slightly lower than that of tier 1 cities, which suggests market potential in 2-3 cities.

- While franchised stores and counters remain favorite places for female consumers in tier 2-3 cities, a small number of them have started trying online purchasing as those in tier 1 city do. This suggests that online marketing will become more important.

- The tier 2-3 market is dominated by four major cosmetics brands. This shows that marketing segmentation is highly necessary as the market is still segmented with diverse consumer demands.

- The female consumer loyalty to cosmetics brand is lower in tier 2-3 cities, giving new brands opportunities to enter and old ones challenges to retain clients.

- Based on a Market Segmentation Model, we divide the female consumers in tier 2-3 cities into six types, namely function buyer, fashion buyer, popularly-oriented, health buyer, consumption leader and rationally-oriented. By profiling and positioning each type of consumers, we have helped clients to devise effective marketing strategies.

Our product innovation research: help you get inspiration and launch marketable products/services.

Our product innovation research helps you develop more consumer-oriented products/services according to market segmentation. With growing demand for personalized service, companies need to improve consumer experience by innovation.

- What kind of products/services should you provide? What do consumers want? How to meet their needs in the best way?

- With several new products to launch, which concept should be introduced? Do consumers need and favor the function of the products? What kind of design appeals to them? Are the products in line with their values?

What are the features and strengths of our product innovation research?

- With professional experience in international design and consulting companies, our team is well versed in the process and tools of innovation research.

- Design thinking guides the whole process.

- We understand what kind of information is most indicative for design/innovation and how to convert research result into practical output.

- We use a range of test methods and tools for design evaluation.

What services are provided in our product innovation research?

Design research support:

To meet your design needs, we engage in a complete process of customized work, from adopting research methodologies, respondent recruitment, field work and moderation, to analyzing raw data and yielding practical research results.

Full-process testing:

Testing for the whole product life-cycle

- Stage of ideation: benefit of products/service, product positioning research

- Stage of concept creation: products/service concept testing

- Stage of development: package testing, product name/icon/slogan testing, flavor testing, product placement testing, sample testing

- Stage of trial marketing: pricing testing

- Stage of market launch: products/services improvement and upgrade

case study

Typical projects of our product innovation research #1 - FMCG Industry:

Study on marketing planning with Chinese elements

What was the project background?

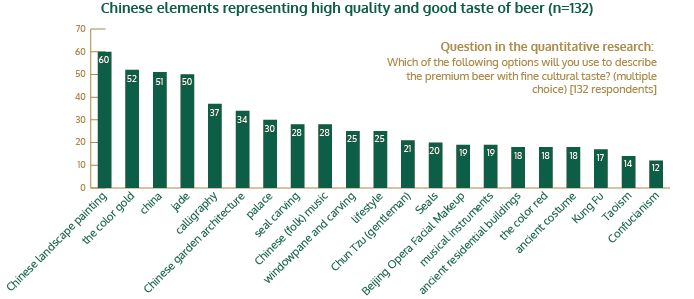

Beer Brand A intended to create an image of high quality and fine cultural taste with Chinese characteristics. Thus a Chinese element which can strike a chord with the target consumers should be found to facilitate brand marketing.

What did we do?

In accordance with brand positioning, we designed a 3-step research process involving multimedia diaries (qualitative research) and questionnaires (quantitative research).

- Step 1: To identify a Chinese element symbolizing high quality and fine cultural taste.

- Step 2: To summarize the common characteristics of premium products with fine cultural taste.

- Step 3: To work out connection between the Chinese element and the brand, both showing high quality and fine cultural taste taste.

What was the outcome?

As shown in the findings, the following Chinese elements represent high quality and fine cultural taste of beer: Chinese landscape painting, the color of gold, china, jade, calligraphy, Chinese garden architecture, etc.

As shown by the bar chart, “Chinese landscape painting” tops the list. After the quantitative research, we furthered our study with a series of open-ended questions. The respondents illustrated their preference for “Chinese landscape painting” from the aspects of art/culture, self-cultivation and the natural sceneries which are consistent with the taste and quality of beer.

- Freshness, elegance and magnificence

- Chinese artistic style and cultural connotation

- The limpidity of rivers and grandeur of mountains are consistent with the quality of beer: crystal look and fantastic taste.

- Smooth lines and refined painting symbolize the wonderful experience when wheat beer taste flows through the throat

- The soul and artistic conception of natural sceneries

To make our research findings more convincing, we also included part of the respondent recordings that helped the client understand consumers' preference in a more straightforward manner.

- "Chinese landscape paintings, featuring conciseness and elegance with Chinese characteristics, distinguish itself from oil paintings in foreign countries."

- "Chinese landscape paintings are integrated with the nature, while beer with a fine cultural taste brings you back to nature."

- "Fine Chinese landscape paintings, with smooth lines and refined delineation, represent elegance and magnificence. Similarly, good beer provides wonderful experience when its wheat taste flows through my throat."

- "Landscapes of lofty mountains and limpid rivers make up a picture of poetic natural scenery."

Having adopted the element of Chinese landscape paintings to their products and marketing campaigns, our client has come up with a clearer brand image and increasing brand popularity.

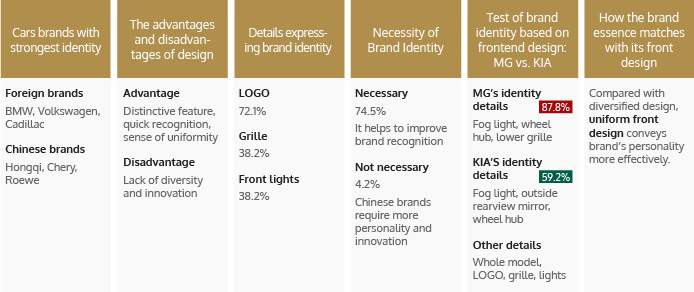

Typical projects of our product innovation research #2 - Automobiles Industry:

Innovation research on the brand identity of a car's front design

What was the project background?

The models of Car Manufacturer A have failed to convey a consistent brand identity through its front design. Do consumers care about such consistency? What details should be involved and what improvement can be made to convey a consistent brand identity?

What did we do?

To answer these questions, our automotive research team devised a series of methods, such as quantitative questionnaires (problem identification), focus groups (in-depth research), and multimedia diaries (finding solutions).

What was the outcome?

The research provides indicative findings for designers as below:

Our marketing planning research: to help you make effective marketing decisions

- Pricing: How much should you price a new product? If the price of competing products is stable, how should you adjust your price to gain a larger market share? How should you deal with price changes of competing products?

- Publicity: Who is the target audience? What should we promote and by what means? What kind of information is conveyed by a specific advertising style? Who should be your spokesperson?

- Promotion: Is the frequency of promotion campaigns reasonable? How are the plans received by the market? How to choose the products on sales?

- We provide you with a portfolio of marketing tools to support your marketing planning.

What are the features and strengths of our marketing-planning research?

- Teamwork: Our team consists of experts with professional experience in 4A advertising companies, marketing departments of multinational companies, and consulting companies, etc. We understand your every need and bring research findings to practical use.

- Models: Accurate information about consumer preferences is obtained through reliable research models, such as AttributeMIX™(price adjustment model), Touch3™(celebrity endorsement test), GiftTracker™(advertising pre-test), EffectOUT™(advertising effectiveness test), EffectOUT™(promotion/activity effectiveness test).

- Tools: We help you better apply research findings to marketing planning with our key research tools, such as strategic tools for corporate ROI growth and for Campaign effectiveness improvement.

What services are provided in our marketing planning research?

- Pricing Research for New Product

- Price Adjustment Research

- Copy Test

- Celebrity Endorsement Test

- Advertising Pre-testing

- Advertising Effectiveness Study

- Promotion/ Campaign Effectiveness Study

- Research on Crisis Communicatio

case study

Typical projects of our marketing planning research #1 - 3C, IT & Internet Industry:

What was the project background?

A video website has improved its competitiveness rapidly after one-year development. The number of its users, however, stagnated after reaching 100 million. To acquire new users, it decided to launch a new seasonal promotion campaign. We were commissioned to evaluate the effect of three visual designs before the campaign.

What did we do?

We decided to organize focus group discussion, as it allowed us to collect more valuable information through presentation and interaction. After assessing aspects like visual impact, aesthetic and information delivery, we came to the following conclusions.

What was the outcome?

- Visual impact: On the whole, the visual impact is rated as good because of the spokesperson. Respondents receive information through three sources in descending order of importance: spokesperson, ipad and slogan. However, the logo attracted very little attention from them.

- Overall visual assessment: respondents give favorable comments on the overall effect mainly because of the spokesperson. Most of them approve the color mix and the match of images and slogans while some think the designs are not appealing and distinctive.

- Information delivery assessment: information presented to the respondents include high quality of the website, its target audience as well as the message “the video website is accessible with ipad” , but the screenshots conveying this message is not highlighted.

- Room for improvement: With the prominent images of ipad, the respondents mistake the designs for advertising ipad. To leave consumers with a lasting impression, the website has to highlight its feature more effectively. Although the advertisement is of higher quality and artistic criterion than the average, it is expected to show more originality.

With thorough assessments, we helped our client select the most suitable design and offered suggestions for improvement.

Typical projects of our marketing planning research #2 - Luxury Goods Industry:

What was the project background?

To acquire new consumers and produce new momentum for sales growth in China, a high-end women's bag brand decided to launch brand marketing targeting China's new elite. Our project team was commissioned to work out a tailored research plan.

What did we do?

Phase 1 Desk Study:

get general knowledge of the characteristics and life styles of China's new elite.

85% of the Mainland China's new elite is between 25 and 39, that is, born in the mid- and late 1960s and 1970s. 75% of them are well-educated with bachelor degrees or above. Nearly 50% of them are mid-and high-level managers in companies, technical experts or civil servants.

The wealth of China's new elite mainly consists of stable high income, real estates, financial assets and household durable consumption goods. All of them hold financial assets; 95% of them own real estates and 78% have cars. As consumers, they have strong brand awareness with particular interests in international brands.

Most of the China's new elite are open-minded and tolerant. They tend to accept new things and views. 79.6% of them describe themselves as those “who are open-minded and willing to accept others' life styles”, 67% “enjoy trying new things” and 59% “tend to accept new things in the society”. They spend an average of 15 hours a week on the internet and usually read economic newspapers. 71% of them “keep a close eye on the economic trend of China”.

Phase 2 Focus Group Discussions:

understand the essential needs of consumers in high-end women's bags by engaging both male and female target consumers in different professions.

For example, the bag should be a symbol of luxury, not extravagance. The bags should be designed to meet their needs for individualized fashion and in different occasions.

Phase 3 Multimedia Diaries:

receive feedback and innovative ideas about the brand marketing from the typical China's new elite.

In this way, we helped the brand work out a strategy for the niche marketing.

What was the outcome?

1. Advertising communication strategies

As the most important channel to inform the new elite about a luxury brand, advertising should aim at creating its luxurious identity. Also, the design of advertisement should reveal its brand culture and positioning. Advertising appeals need to be emotional and cater to the new elite's needs for identification. Meanwhile, advertising should advocate and update the latest life styles and philosophies, such as low carbon, technologies or getting back to nature.

2. Platforms of advertising

Advertising should not be displayed on mass media but small group media in match with positioning of the brand as well as the financial and social status of the new elite. For example, we can advertise on the insets of high-end fashion magazines, media in planes, premium business cars, high-grade leisure centers and gyms. or extend our influence with customers' mouth-to-mouth recommendation. Besides, store advertising is crucial as it can offer distinctive consuming experiences to China's new elite.

Our branding research helps you increase your brand value and build up your brand equity

-

Brand health index: To measure brand performance on various market indices and find out the reasons for good/bad performance.

-

Brand image profiling: To identify gaps between the expected brand image and that in consumer' perception.

the market changes because of new entrants and new competitive strategies? -

Brand effectiveness tracking: To find out whether the brand has improved its market performance and status by developing new markets and introducing new media; whether it has enhanced its public image; and whether the market changes because of new entrants and new competitive strategies?

What are the features and strengths of our branding research?

Features of our models:

our distinctive 3C branding research model (category development, competition of brands and corporate campaigns & advertisements) helps you apply the research findings to the marketing campaign and offers all-dimensional guidance to the short-term, mid-term and long-term strategies.

Revision:

Developing for nearly a decade and integrating new internet technology, our branding solutions draw on the essence of classical branding research theories, with a focus on its real-world application.

5 advantages of our branding research:

A consistent 3C perspective

A thorough tracking of the process of brand development

An instructive marketing plan developed by connecting brand tracking with marketing input and output

14 practical strategic tools to direct marketing campaigns

A full-dimensional tracking mode integrating the means of questionnaires, online survey, and data analysis

Our branding research service

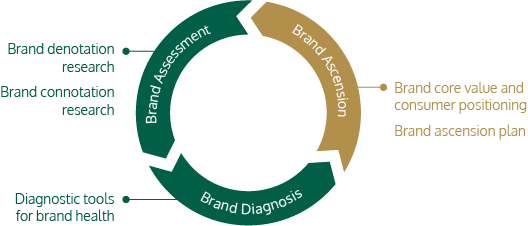

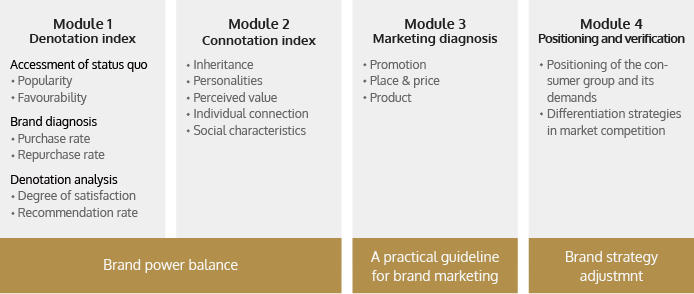

As a process of finding and solving problems, brand management consists of three stages:

Assessment, diagnosis and ascension.In all three stages, we have feasible methods and models to meet the objectives of each stage.

case study

Typical projects of our branding research - Clothing Industry:

What was the project background?

In the fierce competitions among menswear brands, brand effect is the core. The brand development strategy of Company A, a clothing brand is neither in line with its vision nor the current market and therefore needs an urgent transformation. The Company intends to use consumer research to diagnose problems in the current stage of brand development and understand fundamental aspects of the brand. Through consumer research, it also hopes to gain more insights into its competitors and the market trends, thus making better preparations for its annual brand promotions.

What did we do?

In order to reach more consumers from cities of lower tiers and make the sample more representative, an online sampling survey was carried out to collect information of 4,200 samples from 14 provinces (including municipal cities and autonomous regions).

Upon a thorough evaluation and examination of the company's brand, we discovered that the brand was not as strong as it looked. Although it had seen an increase in both popularity and sales through strong advertising and wide distribution channels, its marketing strategies were not sustainable for two reasons. Firstly, philosophy presented in the advertising is not closely linked to the brand. Secondly, both the stores and products cannot deliver what the brand exactly stands for. Therefore, in spite of large sales volume, the brand has yet to become a leader in the menswear filed, as customers are not so emotionally attached as to remain loyal to the brand.

What was the outcome?

Having examined the status quo of the brand, we helped our clients to redefine its brand identity as “experts in menswear and key benefit as “finest materials”. The new product line is intended to offer individual emotional appeal (personal value) as well as a consistent rational appeal (brand identity and key benefit).

Our satisfaction and loyalty research: enhance your user experience

- Understand demands and expectations of customers for products/services.

- Evaluate your performance in terms of meeting consumer demands and compare it with that of competitors.

- Identify competition strengths and weaknesses

- Find out key factors that impact consumer satisfaction with products and services.

- Prioritize product/service improvement plans and enhance customer satisfaction with more effective use of resources.

- Set overall quality management standards for your company.

What are the features and strengths of our satisfaction and loyalty research?

- Our satisfaction research aims to understand what factors push consumers to engage in repeated purchase brand recommendation. Therefore, apart from consumer satisfaction, consumer loyalty and recommendation rate also need to be studied.

- Our well-developed research tools, such as the NPS assessment tools for importance and satisfaction matrix, and for loyalty and recommendation rate, helps clients better devise strategies to improve consumer satisfaction and loyalty.

What services are provided in our consumer satisfaction and loyalty research?

- Consumer satisfaction and loyalty research

- Dealer satisfaction research

case study

Typical projects of our consumer satisfaction and loyalty research - Medical Industry:

What was the project background?

A medical equipment manufacturer hoped to receive, through consumer satisfaction research, reliable and timely feedback in terms of how consumers perceive its products/services, and what are the areas for improvement expected by them.

What did we do?

To begin with, we conducted in-depth qualitative surveys among experts of the medical equipment industry, chief physicians who use medical equipment and decision-makers in hospital equipment purchases, and designed a corresponding satisfaction assessment system. Then we asked chief physicians who use medical equipment in over 400 top hospitals across the country via CATI and appointed interviews to evaluate products of this manufacturer and those of its competitors in terms of the whole sales process and product functions. Based on the satisfaction assessment model, consumer structural analytic tool and the importance/consumer satisfaction matrix, we conducted in-depth data analysis and came to the following conclusions.

What was the outcome?

- While consumer satisfaction with the products/services of this manufacturer is rather high, their loyalty is relatively low, which means that the manufacturer faces a major risk of losing its consumers.

- East and West China are key areas where the manufacturer needs to improve its service.

- CT users show the highest satisfaction and the color Doppler ultrasound users the lowest. In terms of X-rays, the after-sales service is better the pre-sales service. As for nuclear magnetic resonance, the pre-sales service is better than the after-sales service.

- While the manufacture stands out in its service proactiveness, it falls short of consumer expectation in service effectiveness and communication. Compared with the amount of service it provides for customers who have bought the insurance, the manufacturer fails to satisfy those who haven't. Furthermore, its after-sales service does not meet consumer expectations and needs special attention in future improvement plans.

- International brands like Siemens, GE, and Philips will be the biggest competitors of this brand.

Our research conclusions provided quantitative information that enabled the client to make more informed decisions, particularly for its marketing, R&D and sales departments to offer better consumer service and stand out in the fierce market competitions.

About our workshop service:

Workshops as a creative method to generate innovation have been adopted by many design/advertising/marketing/branding agencies and established companies.

We work closely with our clients to design and organize workshops regularly. We design methodologies and processes for each workshop involving participants in discussion, understanding and creation. No matter in a leading role or a supporting role, we have our unique advantages.

Our advantages:

Rich experience:

- We run workshops with our clients from different industries on a regular base.

- We constantly study and develop new processes and methods for workshops, and we adapt them to specific project needs.

Abundant resources:

- We help you to find exciting local venues to boost your creativity.

- We invite industry experts and opinion leaders for your workshop as external inspiration.

- We have bilingual moderators and a professional translation and interpretation team to better serve the needs of multinational companies.

Professional equipment:

- We provide professional equipment to suit your specific requirements, such as an omnidirectional camera and a live telecast to engage your colleagues located globally.

Exceptional execution:

- From site arrangements, catering, to video documentary, we have an experienced team to ensure everything is in perfect order for your workshop.

- We can help to document the process and outcome of the workshop in photos, audio, or video.

Applying psychological tools and innovative methods, we provide tailored workshops for different stages of the lifecycle your product is in.

- Help you better understand your customers: during the research stage, we help you to engage directly with your customers.

- Help you apply the research results to your products or marketing program: we work with you together to convert research findings into viable concepts. We can also organize consumer participation in the process of concept creation.

- Help you learn the customers’ feedback: after you have the prototypes or the pilot runs of your products/services, we facilitate you to gather first-hand feedback from your customer.

About our online survey

- We are a leading professional market research company with samples from all across China.

- We have nearly 8,000, 000 online survey samples in China with an average reaction rate over 10% and active sample rate up to 50%.

- Our sample database covers various types of ordinary consumers as well as professional practitioners, such as doctors and IT experts.

- We can collect 2000+ questionnaires in a single day.

- We are the sole designated supplier of online survey and online samples for the DMCG Group.

Our products

- System Rental Service: if you have your own survey samples (respondents) and can design questionnaires and initiate new topics by yourselves, you can rent our online platform for simple data analysis.

- System Rental + Member Sample Database Services: you can recruit respondents through our platform, and use it to conduct research and data analysis.

- System Rental + Member Sample Database Services + Research Service: as per your research request, we design questionnaires and invite eligible members to fill them in. In the end, our professional researchers will provide you with a comprehensive analysis report..

Application:

- Consumer satisfaction research

- Employee satisfaction research

- Product satisfaction research

- Meeting and event planning

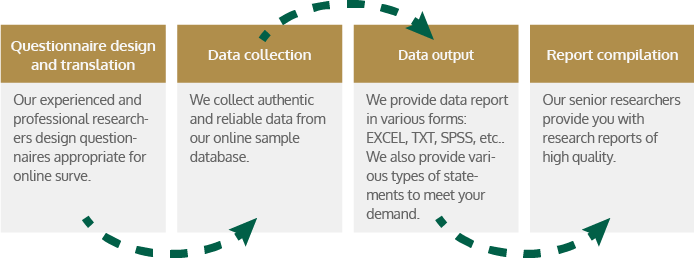

Our Process

Our Panel Distribution

Sample Data Base in China 7717317

| Class | City Name | Male | Female |

|---|---|---|---|

| Tier 1 & 2 | Beijing | 244785 | 294385 |

| Tianjin | 94772 | 62451 | |

| Shenyang | 65285 | 50009 | |

| Dalian | 48542 | 34713 | |

| Harbin | 61365 | 30994 | |

| Ji'nan | 100882 | 51898 | |

| Qingdao | 102108 | 56401 | |

| Nanjing | 97525 | 67415 | |

| Shanghai | 289701 | 259873 | |

| Hangzhou | 117324 | 81104 | |

| Wuhan | 132338 | 76179 | |

| Guangzhou | 303410 | 183433 | |

| Shenzhen | 222125 | 127374 | |

| Hongkong | 2070 | 1628 | |

| Macao | 583 | 583 | |

| Chongqing | 118650 | 60823 | |

| Chengdu | 123314 | 76481 | |

| Xi'an | 104721 | 42089 | |

| Tier 3 | 1124273 | 569879 | |

| Tier 4 | 1178248 | 588731 | |

| Tier 5 | 335228 | 133625 |

Our Quality Control

We have established a complete network of samples in China. Its recruitment, management and operation are in full compliance with the strict and detailed YEINSIGHT Standards, including:

- Multiple recruitment channels to ensure an extensive source of samples.

- Sample management regulation.

- Control and detection of false registrations.

- Detection and management of respondents giving false responses.

- Privacy and information security